Is saving money on your shopping list?

Before we go any further, you must know this – it’s NOT all your fault. Repeat after me; “It’s NOT all my fault.”

But you also have to know this – some of it IS your fault.

We’re talking about overspending.

About why we go beyond our means, buying stuff, and spending money on things we only slightly want but really don’t need.

We’re talking about our bad spending habits. About splurging in sales and online on clothes we may never wear, on food we’ll never eat, on credit cards we forget to repay, on energy we waste through open doors and windows, on gadgets that are outdated as soon as we buy them.

But we do. We continue to overspend, and it’s not good for our physical or mental health.

Shop smart - save more

Sometimes there is a need for specific products to buy, including food, clothing, transportation expenses and more. By using a rewards app, you will save big with every purchase and won’t have to worry about breaking your bank.

Unnecessary things

But never fear, there’s hope at hand, once you realise that it’s NOT all your fault.

The world around us is designed to make us spend.

Everywhere we look something is vying for our attention. A neon sign. A bus siding. Shop windows. Complimentary colours. New hairstyles. Boots to die for. A bigger house. A faster car.

To demonstrate, let’s try a quick experiment.

Take 30 seconds and look around you.

I’m betting that someone somewhere is trying to sell you something at this very moment. Either directly in your face or with subliminal messages that are still alive in your memory even after you can no longer see them.

Marketers are clever

You see, marketers are very good at their job, and they live by the following principle.

‘You can’t make people spend money on things they don’t want, but you can make them spend money on things they don’t need.’

If people stop spending money, the marketing business is doomed to perish in a blazing bonfire of coupons, special offers, two-for-ones, one-time-only deals, and cashback rewards.

Why do we overspend?

Most of the reasons for overspending are directly linked to human emotions. To put it simply, we like spending money, we like to part with our cash, and we like to live what we perceive as the best lifestyle. It makes us happy.

Peer pressure

As much as we dislike the idea, nobody likes to be left out. Whether it’s an invitation to a party, a new car, an item of must-have clothing, or a genre of music, we usually try to conform – even if we have to overspend to do it. The problem with keeping up with the Joneses is that nobody really knows what’s going on in their house, or whether they can afford it or not.

To feel good

It’s a fact, our bodies have learned to release the feel-good endorphin dopamine when we buy something that feels nice. Sadly, our bodies have become addicted to this feeling and require the stimulus more often than is good for us or our hard earned cash. Dopamine causes us to make spending decisions that we often regret later.

If you have to buy something online, at least try to get the best value that you can.

Monetha is an online shopping rewards app that gives points for spending money with one of its online partners. The accumulated points can then be used to exchange for gift cards from some great stores like Amazon, Nike, and thousands of other household brands. The points can also be traded for cryptocurrency or used to donate to a charity of your choice.

Shop smart - save more

Sometimes there is a need for specific products to buy, including food, clothing, transportation expenses and more. By using a rewards app, you will save big with every purchase and won’t have to worry about breaking your bank.

We abuse credit facilities

Credit cards are a fantastic facility to have – if you know how to use them wisely. However, misusing a credit card can be a fast track to overspending, financial misery, and debt. The problem seems to be that people tend to spend more money when they pay by credit card. That’s either because they’re deluded by the idea that they’re not paying with real cash or the simple notion that everything will be alright in the future.

We have poor self control

Who knows where we picked up our bad habits from, our parents, our siblings, friends, or even colleagues? Wherever we get the inclination to overspend, saying ‘no’ to excessive spending seems difficult for many of us.

The only way to overcome poor self discipline is to learn how to say ‘no’ and to think ahead.

Too convenient

Sometimes it feels like shops are chasing us everywhere we go, especially online. Browsing the internet and social media accounts is one of the main spending triggers that damages our bank balance. We have to be disciplined when it comes to compulsive spending habits.

If we know that searching a particular website usually triggers us to rifle our bank account it’s time to stop going there. We know, easier said than done, but if you want to stop spending money and achieve your financial goals, discipline has to be the number one weapon in your armoury.

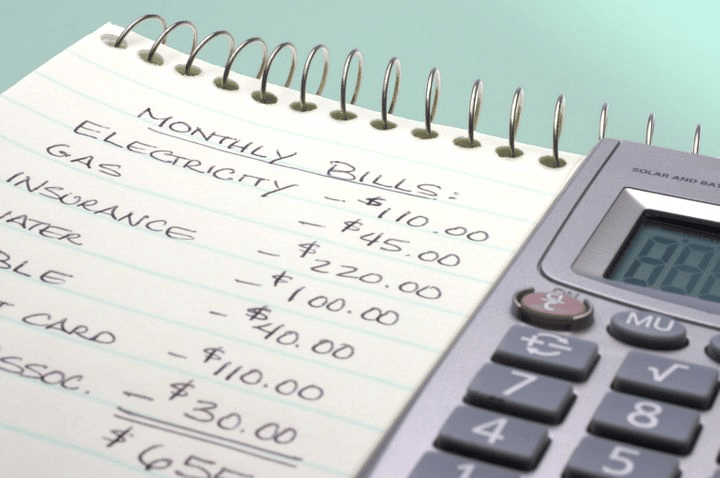

No budget in place

Not having a working budget in place to manage our cash flow is one of the main causes of overspending. Most of us overspend because we have no idea how much we spent last week, last month, or last year because we have no detailed budget in place.

A budget helps us to stay focused on our spending habits and helps us to avoid temptation, at least when it comes to spending money. Some great, and free apps can help you manage your budget without feeling like you’ve turned into a Scrooge.

But how do we stop overspending?

Fixed expenses

Many of our regular payments go towards paying for services we no longer use, are outdated, or have been reduced in price since we signed up.

We give over our hard-earned cash for magazine subscriptions, memberships to organisations, and other standing orders.

These need to be reviewed and we need to assess if they are still valid and worth the debt being incurred. If not, they’re not paying their way and they have to go.

6 tips on how to stop spending money

Most of us spend money on the same things; food, transport, housing, energy, utilities, clothing, and entertainment.

Of course, there are other things we splurge on, like travel, luxury experiences, stuff we can’t afford, and even gambling (yes, lottery tickets are a form of gambling).

When everything is combined whether we’ve stuck to our budget or not makes all the difference to if we can save money and stick to our savings goal, or whether impulse shopping is draining our bank accounts and leaving us in debt.

For the majority of us, knowing how to stop spending money is an ongoing battle that requires the use of specialised weapons.

Know what you’re spending money on?

It might make you cringe a little – or a lot – to understand your past spending habits.

But, without understanding where your money is going, you’ll have no chance of fully understanding how to stop spending money.

Listen closely!

Making a budget, and sticking to it week after week and month after month is the only policy that’s going to help you quit spending yourself into debt.

Make an analysis

A detailed analysis of what you spend can give you some useful insights and go a long way to feeding your savings account.

For example, let’s say that you pay €5 a day for a parking spot next to your workplace. Sure, there’s a free space nearby, but it’s a 7-minute walk, and what if it’s raining?

Because you don’t want to get wet (have you heard of umbrellas?) that works out to €25 a week, or, €100 a month. Or put it another way, that might just break your heart, over €1,000 a year, a bit more than spare change I think you’ll agree.

Knowing exactly where you’re spending money can help you reduce a lot of your financial stress, and help you with things like debt repayments, exploding energy bills, or just making ends meet with the bare necessities.

Once you know what the real necessities are you can start to make smarter decisions when it comes to knowing how to stop spending money that you don’t have.

Know what you spend on

Also, when you know where and on what you have to spend your money, you can make smarter decisions.

You can use an app to that offers comparative prices, shop around until you find what you want, or even use the cashback option on your credit card to make even a small saving and take you one step further from debt.

A budget means better spending habits

Once you’ve gone to the trouble of understanding where you’re money is gone, you can use a well-planned budget to change your spending habits and make your debt payments on time every time.

And remember this, don’t beat yourself up if you don’t get it right the first time. It’s a working budget and needs a little planning to get it right.

Stay motivated and focused on your finances, and be aware of changes that you have no control over – price increases, seasonal factors, a new hobby, an unforeseen potential purchase, or any discretionary spending that you might have to make.

Once you’ve paid your main bills according to your budget, you’re free to change your savings goal, shop online for something special, or even treat yourself to a little – but well-managed – retail therapy.

Use a rewards programme

If you have to make a purchase online, signing up for a rewards programme like Monetha should be your first step. It’s free, you have hundreds, if not thousands of shops to choose from, and when you do spend your money you’ll get rewards points in return.

You can then use the points to exchange for gift cards that can be used to get free goods and great discounts in hundreds of popular brand stores. You can even use your points to invest in cryptocurrencies or to make a donation to a charity.

A rewards app that you can trust

Get the most exciting deals on your favorite items and exchange your received points to gift cards, crypto or charity donations. The app is simple to use, it’s effective and it’s free!

That’s how to stop negatively spending money and how to make your budgeted purchases work for you and bring you the rewards.

Set limits on your shopping list

Before you go shopping make a list of what you need – and never go food shopping hungry unless you want to spend too much (at least that’s my golden rule). And if you have to shop online, try to use a credit card with a cashback option, even if it’s only 1% cashback, your paying less money than you thought.

Make a list and check it twice

Having a shopping list will help steer you away from making an impulse buy or a big purchase that’s not on the list. Your goal is to stop spending and start meeting your financial goals.

If there are any particular shopping sites or high street stores where unnecessary things seem to find their way, mysteriously, into your checkout basket, perhaps it’s better to start avoiding those stores like the plague.

Beware of the true cost of sales

If you think retailers have seasonal sales and special offer events just to make you feel good about yourself you have another thing coming.

Ok, before I come across like a Grinch, I know that we all love a bargain, and retailers know that too.

Sales are designed to get shoppers or potential shoppers inside the doors. The original offers published by the retailers are the temptation that set the desire in motion.

Caveat emptor

For example. The sign says 75% Off refrigerators!

That sounds like a great deal, right? But what the sign didn’t tell you was that there are only two refrigerators in stock at that price, and they’ve already been sold to the office assistant and the shoe department manager’s wife. Don’t fall prey to their tricks, and they have lots of them.

Many of us buy things we don’t need, we’ll never use, or are shoddy quality just because the sign says it’s a great deal. If it’s not on your list, you can’t have it.

Always on sale

Plus, online shops can run sales and sales events anytime they want. They’re not constrained by seasons, weather, local events and circumstances, or even staff to man the counters.

If something is reduced in price one day, it’s likely to be reduced again. In fact, many online stores have designated pages dedicated entirely to price cuts and sales. The deals will exist no matter whether there are sales or not.

Restaurant or packed lunch?

I know, this one will make me highly unpopular, but I’m speaking from experience.

Every working day I used to go to a restaurant for lunch. Nothing fancy, just a tiny cafe where a lasagne and chips or a club sandwich set me back about €6 a day, or €30 a week, or… gulp… €120 a month. Almost €1,500 from my annual income.

It seemed reasonable, at the time, until I realised that after work I would go home and cook dinner costing me even more money. It was nice to get out of the office and go to the cafe, but it was costing way too much money and I was double spending when I should have been saving.

Tasty savings

Tasty savings indeed

Every time you shop online via Monetha’s app you get rewarded. Whether it’s free gift cards or cryptocurrencies – you will save big using the app.

So, every day I made a packed lunch, from the food shopping that had already been budgeted for, went to the local park or the canteen, took a shorter lunch break, and left work 30 minutes earlier each day. Win-win situation.

Just to redeem myself ever so slightly, I’m not saying that you should never treat yourself to a Sunday lunch or a celebratory meal in a nice restaurant, just make sure that your budget allows for it.

Oh, and pay for it with your cashback credit or debit cards (that’ll pay for dessert at least).

There are hundreds of ways to stop spending

There are hundreds of ways that can help you to stop spending money and strengthen your finances.

Most of the suggestions that I could make are common sense.

-

Walk or cycle instead of taking the car.

-

Never borrow money

-

Invest a portion of your income wisely

-

Shop at the supermarket using a cashback card or discount card

-

Make the most of vouchers and coupons

-

Beware of social media adverts

-

Try a zero-spend challenge

And, there are hundreds more, just try to think creatively.

Conclusion – stop spending and save

However, the basis of all your efforts on how to stop spending money starts with knowing how much you spend, where you spend it, what you spend it on, and creating a budget that you stick to.

To get more value from your income, try to make use of reward programmes, discount cards, cashback offers, gift cards, and coupons, but only for items or services that are a part of your planned budget.

Never settle for the first price

Many consumers just take the first price that comes their way, and never resort to using any cashback or savings methods designed to reduce their spending.

Retailers want you to shop in their store, even if you’re restricted to a tight budget. Keep an eye out for the latest deals and discounts they put on offer and make use of them.