What are money saving apps?

Ok, so what are we talking about here?

Firstly, we’re talking about apps that help us to save actual money, cash, greenbacks, moolah, and dough, like in a bank account. They can also help you manage your savings goals and savings account, keep track of your energy bills, give you regular spending insights, and help you make the right financial decisions.

Secondly, we’re also talking about apps to save money by finding the best bargains, deals, coupons, and rewards when we shop. They can help you save money in high street stores, get the lowest price online deals, earn cashback, and get access to exclusive deals.

Apps to save money

To do that we’re going to try to mix it up and offer you some of the best money saving apps for putting money in the bank, and, for making sure you don’t spend too much in the first place.

But first, a little heads-up on the journey to help you save money and manage your savings account more efficiently.

There are probably tens of thousands of apps out there designed to help you save. Some are good, some not so good. Let’s take a tour.

save more with rewards app

Do regular online shopping and get rewarded with gift cards and crypto via Monetha’s app. It’s easy to use, offers big savings and it’s free!

How does a money saving app work?

Whether you’ve opted for a free app or a paid app, an app to help you save actual money, or an app that helps you make savings on your purchases, let’s take a quick look at how they work.

Mobile apps that help you to save money usually work by taking control of all your accounts and managing them in one convenient location.

Money saving apps will let you automate the process of putting money aside regularly, or by rounding up the spare change in your wallet

Some apps work by analysing your ingoing and outgoing monetary transactions before using an AI algorithm to help discover and calculate any savings that might be made.

After the analysis has been conducted, any savings to be made are usually transferred to the app rather than to your bank accounts.

Best money saving apps

There are far too many apps out there claiming to be the ones that will change your life. But let’s be clear, they’re apps, nothing more, not personal financial gurus or Wall Street traders.

Sure, there are some great apps that will encourage you to become a better saver, and there are some great apps that will point you to the best online shopping deals and discounts.

But unless you use a money saving app regularly or wisely, most of them won’t do anything other than take up space on your smartphone.

Let’s take a look at some of the better ones.

Starling

Cost: Free

What for: Identifying your spending habits and learning to budget.

Description: Starling is a whole bank wrapped up inside one tidy app, plus, it’s kind of fun too. Open a current account from your smartphone in minutes. Learn to invest. Learn how to budget your money, how to limit your spending, and how to improve your money saving ambitions.

If you’re a student for example, just transfer an amount to Starling and track every penny you spend to know how much you have left.

The app also alerts you the moment you spend money and organises spending into different categories like groceries, entertainment, energy, etc. Plus, the app will help you set personal budgets, give yourself spending goals, monitor utility bills and household bills, and send notifications when you spend too much.

And when it comes to your bank balance, it will even inform you when you’ve spent your monthly budget. It’s good to know, but it also means you can’t go see that band you’d been looking forward to.

Revolut

Cost: Free to start saving – Paid upgrade required to access advanced features

What for: Personal finance and money management app that lets you budget, save, invest, transfer, and withdraw your cash instantly.

Description: The Revolut app delivers personal finance and money management instantly. But that’s not all.

It’s often referred to as being ‘the alternative to traditional banks’ as it gives account owners the ability to travel internationally and have a global lifestyle, all while having instant access to their finances.

Revolut lets you round up your transactions to the nearest pound, and save the rest. Your money is always secure and protected internationally. Stash your cash in over 30 currencies and get 1% cashback when you upgrade to Revolut Metal.

With over 20 million global users in over 200 countries, Revolut is fast becoming the one app for all things money.

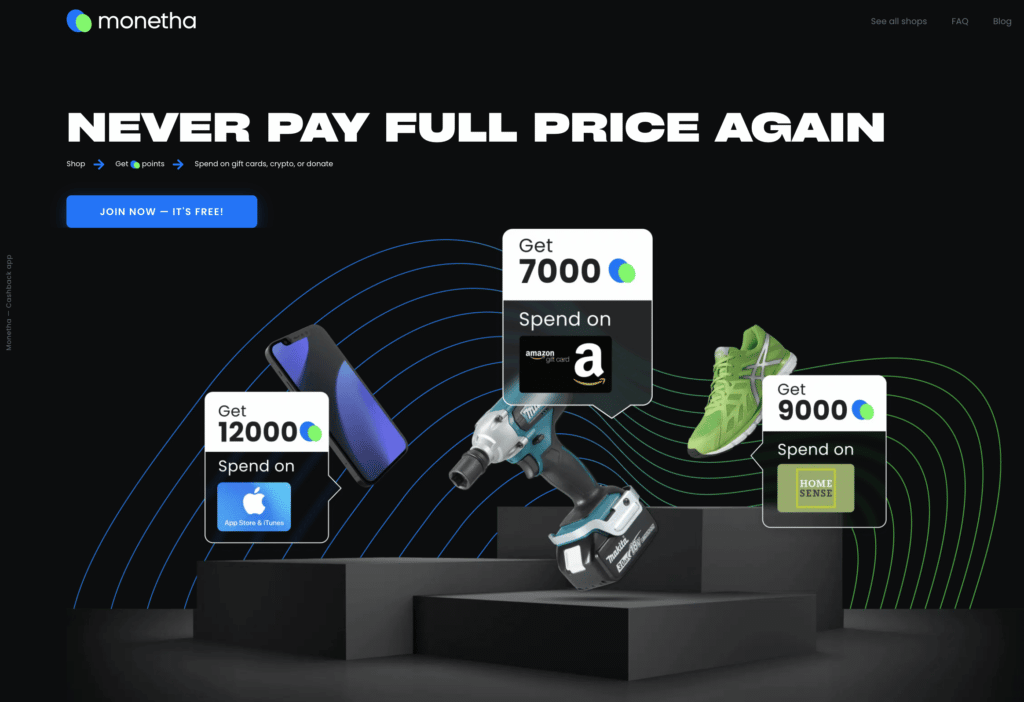

Monetha

Cost: Free

What for: Monetha is a leading online shopping rewards app that lets you earn points and spend them how you like.

Description: When you download the Monetha app you are connected to over 1200 online shopping partners. Every time you purchase something from the online stores or complete paid surveys you will earn cumulative points in the Monetha app.

When you’ve earned enough points – you even receive points just for signing up or recommending a friend – you can exchange them for a huge selection of gift cards from some of the world’s top brands. Or you can redeem your points for cryptocurrency, or use them to make a donation to a deserving charity.

The smart way of saving money while earning rewards for your purchases.

Big savings start here

Using Monetha, you get rewarded with every purchase. Purchase from your favorite shops and get points to exchange to gift cards, crypto or charity donations.

Chip

Cost: Free standard plan, or premium option – £3 every 28 days

What for: Chip analyses your bank transactions, identifies spare change, and sets it aside for you in your savings account like the perfect money saving app.

Description: Chip is like a good friend who keeps an eye on your financial transactions and then lets you know what you can afford to save. As one of the best apps to save money, it will transfer that amount into your savings account every couple of days. You can pause this facility whenever you want for up to 3 months.

Depending on the bank you choose to partner with will determine your rate of interest earnings. However, if you bank with Chip’s partner bank, Allica, you’ll earn 0.9% on your savings. Plus, if you want to invest your money rather than save it, you can do this with both the standard plan and the premium plan – different rates apply.

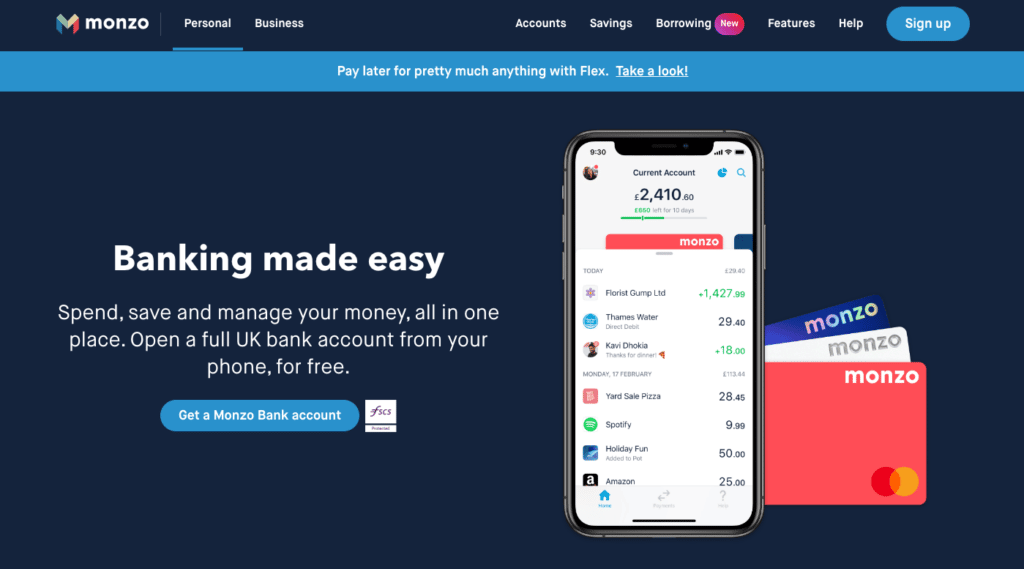

Monzo

Cost: Free

What for: The Monzo app lets you open savings accounts called ‘pots’ for each of your specific goals.

Description: The Monzo bank account app lets you set up money saving accounts called ‘pots’ so that you can manage and monitor your saving goals.

Monzo earns interest of up to 1.36% on your savings. It also lets you round up your spare change every time you spend – for example, if you spend £10,20 on a product, the app will automatically send 80p to your bank account.

The app lets you track your money flow, set limits for different categories, and get warnings if you’re overspending. Plus, there is no charge for using your card abroad.

CheckoutSmart

Cost: Free

What for: Getting cashback on your purchases. Save money as you spend.

Description: A money saving app with a difference, Checkout Smart lets you claim cashback on the things you buy. Even smarter still, the app will send you a daily list of items that offer cashback and the stores where the deals will be available.

When you find a deal you want to take advantage of, make your purchase, take a photo of the receipt and submit it to the app. (But remember, just buy things you need). Once you’ve done all that, you’ll get your cashback transferred directly to the app. How’s that for money saving?

The transferred money can then be transferred to your bank’s savings accounts or redeemed with PayPal. A top money saving tip is to let your money accumulate before withdrawing it. You’ll be charged a fee of 5% if you withdraw less than £20 from your account.

Idealo

Cost: Free

What for: Idealo is perfect for you helping you to compare prices when you shop.

Description: Idealo is a hero for impulsive shoppers who buy on the spur of the moment. If you are one of these impulsive people and you see something you just have to have, open your Idealo app before you take that lonely march to the checkout.

On the app, search for the product or scan the product’s bar code and get price comparisons from other retailers. Who knows, the shop next door could be offering huge savings on the same product.

Now that’s a money saving app.

Vouchercloud

Cost: Free

What for: An app for discovering money saving discounts and coupon codes

Description: There’s nothing new about apps that claim to be the Sherlock Holmes of voucher code discovery, but that was before Vouchercloud.

The Vouchercloud app’s ease of use is what makes you want to use it time and again to help you save money when shopping in-store.

You have 2 options for finding great coupon deals. 1). Browse through featured daily deals. 2). Use the ‘near me’ function to discover great deals close to your actual location. Once you’ve found what you’re looking for, click the ‘use voucher’ at the checkout to show staff the generated discount code.

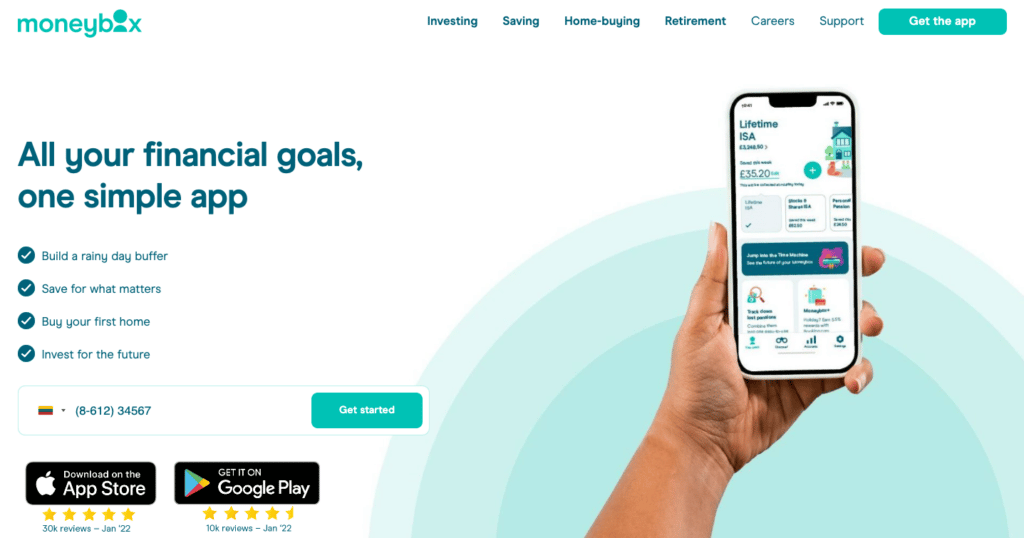

Moneybox

Cost: Free

What for: Savings and investments – all your financial goals in one app

Description: Moneybox offers several money saving functions, including rounding up all your card transactions and either saving or investing the difference.

You can save your money in two ways; a 45-day Notice Account or a 95-day Notice Account, but if you feel that your app is squirreling away more than you can afford you can always turn it off. You can choose from a range of savings accounts like Stocks and Share ISAs, Lifetime ISAs, Personal Pensions, savings accounts, and much more.

Plan for the future with tools like the Lifetime ISA calculator, or the ISA Time Machine. You can withdraw your money from the app once per month.

Welcome bonus is waiting for you

Sign up to the Monetha’s app and get a welcome bonus of 2000 points to accumulate and spend on gift cards, crypto or charity donations.

FAQ

Are money saving apps worth it?

Anything or an app that can help you save money has to be a good thing. An app that lets you track your spending can very quickly point out some unsavoury shopping habits and help you make more savings.

Imagine if you buy a newspaper costing £2.25 every day and never get to read it from front to back, you’re throwing away over £800 per year. I’m sure you could find something better to spend that on or invest in.

The benefits of saving apps:

- They’re usually easy to use and require no effort to help you start saving

- They encourage good saving habits

- They give you attainable savings goals

- They’re a fun way to learn about savings

- You can earn interest

- It removes spending temptations

- Can help you save when travelling

Are money saving apps safe?

For money saving apps to do their job, you have to entrust them with a lot of personal, and sensitive information.

Security is usually a significant concern for app designers and app owners, but how do we know if the apps are safe?

Most apps that involve you divulging sensitive information store your details in a separate database that uses encrypted, multi-level security technology in tandem with passwords.

The only information stored by the app is the non-essential information needed for updating, syncing, or uploading financial data manually.

Having said all that, before you sign up for any app, or online service, check with review sites and technology evaluation sites before you download.

How can I save money fast?

Knowing what you are spending your money on is the first step toward developing healthy saving habits. Money saving apps let you track your spending habits, and even warn you when you’ve exceeded your budget.

But knowing what you spend your money on isn’t enough on its own.

Here are some other suggestions:

- Record your expenses

- Include saving in your budget

- Fit where you can cut your spending

- Set goals for saving

- Know your financial priorities

- Use the right apps and tools

- Automate your saving using an app

- Finally, watch your savings grow

What is the best app for saving money?

If you’re one of those who find it difficult to get into the saving habit, an app just might be what you need. But what are the best money saving apps?

Sadly, the answer to that question is not so straightforward. There are many great apps out there, free or as a premium upgrade. And, the best one, is the one that helps you to start saving or to manage your savings account even better.

However, Nerdwallet, the advice industry’s leader for all things financial, has at least three options to recommend.

- Qapital – Best for goal setting

- Acorns – Best for investment transfers

- Digit – Best for simplicity

We can’t say for sure if these are the best for everyone, but it’s always helpful to get advice from the experts.